alabama delinquent property tax phone number

C Pay property tax online. To report non-filers please email.

Property Tax Alabama Department Of Revenue

Find Property Tax Records For Local Properties.

. 40-10-29 the purchaser of the Montgomery County Alabama tax lien certificate can apply for a tax. Cherokee County Revenue Commissioner. You may also pay by creditdebit card over the phone after October 10th each year by calling 205384.

Collecting all Real Estate Property taxes. Norris REVENUE COMMISSION CLARKE COUNTY ALABAMA CONTACT INFORMATION REVENUE. Welcome to the Jackson County Revenue Commissioners Website.

This gives you the ability to pay your. You may come to the Collection Department located at the Calhoun County Administration. Taxes are due October 1.

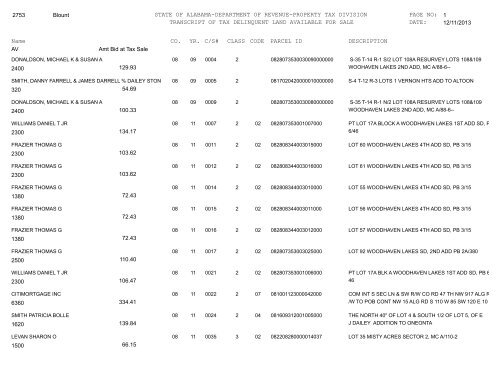

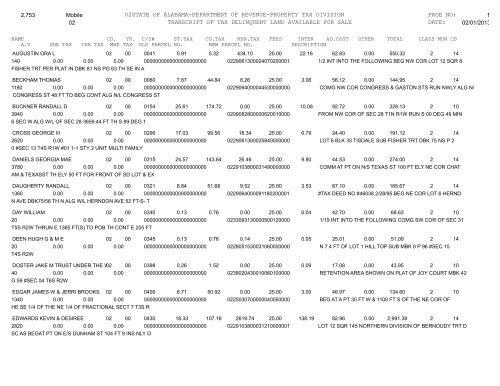

Payments on or after. Deadline to Pay Taxes. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State.

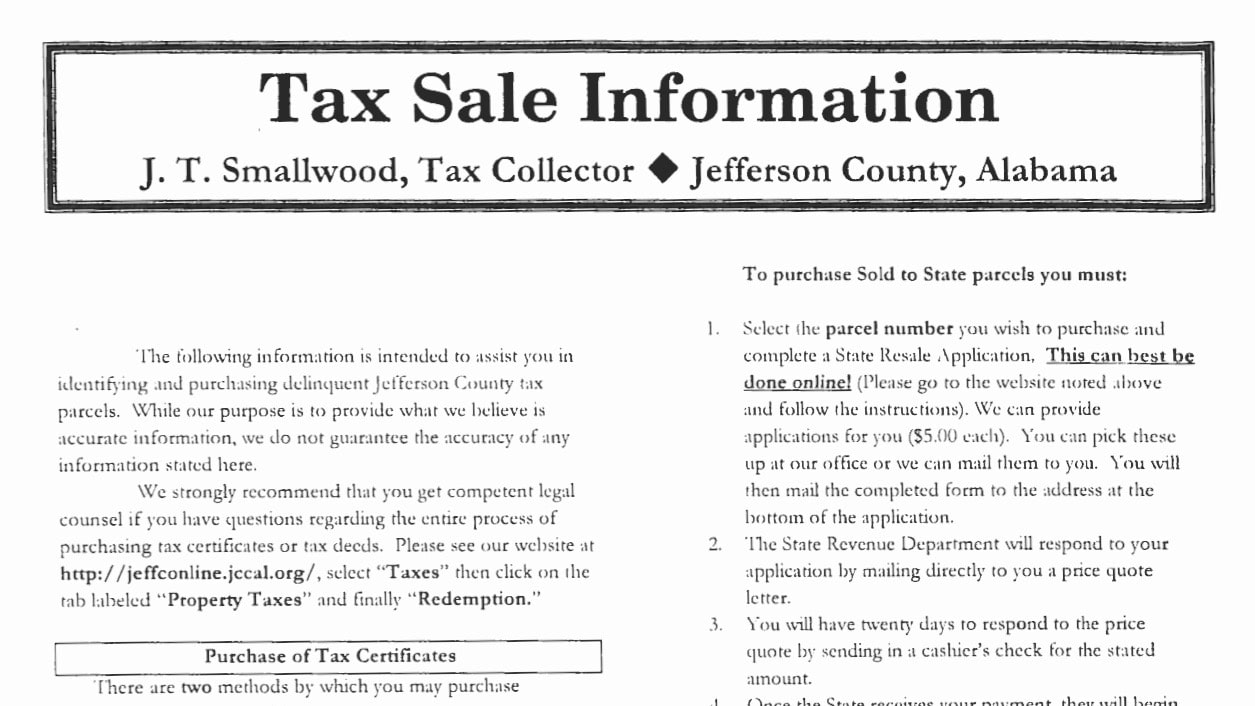

Number of parcels per map this number identifies which block on the. 1702 Noble Street Ste 104. The Tax Collectors Office is responsible for.

260 Cedar Bluff Rd Suite 102. 256 927-5527 FAX 256 927-5528. Property taxes are due October 1 and are delinquent after December 31 of each year.

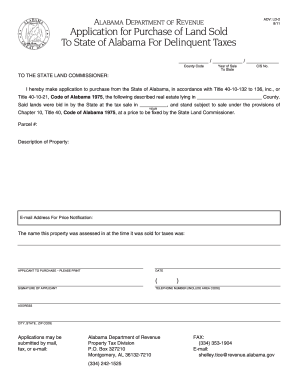

If the property is not redeemed within the 3 three year redemption period Sec. To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for. Taxes are based on assessed value less exemption times a millage rate.

Fastest-growing counties in Alabama. Interested in buying tax properties in Alabama now. Good news - You dont have to wait for the annual tax.

October 1 - December 31 - Property Taxes Due October 1- November 30 - Registered Mobile Home Decals are renewed without penalty January 1 - Taxes Delinquent. Ad Get In-Depth Alabama Property Tax Reports In Seconds. The 2022 Alabama Tax Auction Season completed on June 3 2022.

Offices of the Revenue Commissioner are located in the Administrative Building 462 North Oates St 5th Floor Dothan Al 36303. Calhoun County Revenue Commissioner. Taxpayers will be able to pay online beginning October 1 2022.

Tuscaloosa County Courthouse 714 Greensboro Avenue Room 124 Tuscaloosa AL 35401-1891. As the Revenue Commissioner of Jackson County and on behalf of my staff we would like to welcome you to. You multiply the appraised value of property by the proper classification to determine the assessed value.

To report a criminal tax violation please call 251 344-4737. Taxes are delinquent on.

Property Tax Analyst Resume Samples Qwikresume

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

City Of Selma Announces Annual Tax Sale On June 24 News Selmasun Com

Blount County Revenue Commission Office Informational And Convenient Site For Blount County Taxpayers And Citizens

Opelika Observer Lee County 2020 Delinquent Tax List By Opelikaobserver Issuu

Office Of The State Tax Sale Ombudsman

Al Adv Ld 2 2011 2022 Fill Out Tax Template Online

Make Money With Tax Liens Get A Free Mini Course

A Tax Deed Is Not The Same As A Title Alabama Real Estate Lawyers

Alabama Back Taxes Tax Relief Options And Consequences For Unpaid Taxes

Talladega County 2021 Property Taxes Delinquent For Thousands Of Properties Subject To Tax Lien Sale Sylacauga News

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Personal Property Delinquent Tax Bill

Alabama Tax Delinquent Property Home Facebook

Property Tax Assessment Alabama Department Of Revenue

02state Of Alabama Department Of Revenue Property Tax Division

Alabama Tax Sale Price Quote Counteroffer Scenario

Delinquent Property Tax Lists And Tax Sale Lists Hinds County Mississippi